Time to refinance? Want to buy another home or simply realise the equity in your home? Or maybe you just want to get a better rate…

Why refinance your home loan?

Banks are usually eager to poach mortgage customers from each other and may offer discounts or cash-back incentives to entice you to switch your home loan to them. But changing mortgage providers can be an expensive and time-consuming process and is definitely not something you should do without good reason.

There are many reasons why people do choose to refinance, despite the costs and potential hassle, including:

Other refinancing pitfalls

When you refinance you are, in effect, applying for a brand new mortgage. Even if you go through your existing lender, you may have to prove all over again that you and your property qualify for a home loan.

If your credit rating has worsened, or if the banks’ lending criteria or your financial circumstances have changed, there’s no guarantee that your application will be approved. And if it’s rejected, you could end up with a black mark on your credit rating.

Note, too, that you may not be able to refinance if you have a guarantor on your existing mortgage.

Refinancing for investors

If you’re a property investor rather than a home owner, refinancing can be a very different story.

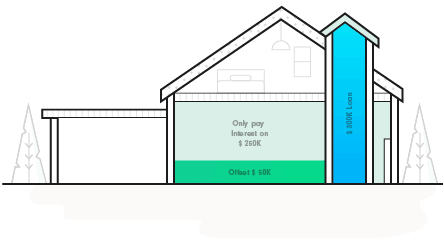

Many investors build a property portfolio by leveraging equity in their existing properties. This can result in ‘cross-collateralisation’, where mortgages are secured on more than one property. Using this strategy may mean that you can acquire another, or even several more properties without having to invest any additional cash.

Cross-collateralisation comes with pitfalls though: primarily that you may end up with less flexibility in future. For example, should you decide to sell one of your properties, your bank might insist that you use the sale proceeds to repay some of the principal on your other loans, to reduce your LVR ratio. There is a higher risk of this if some of your properties have dropped in value, lowering the overall value of your portfolio.

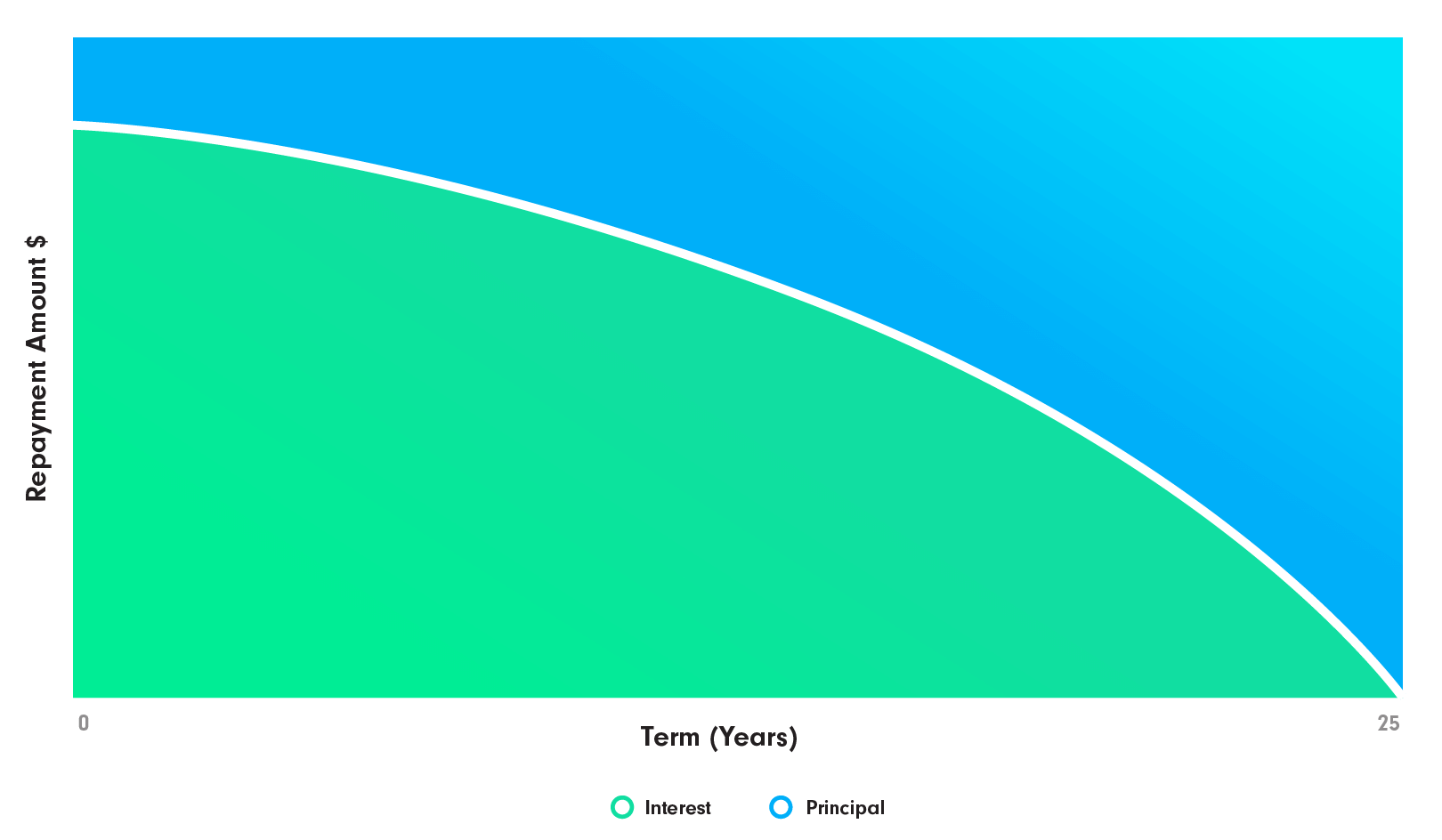

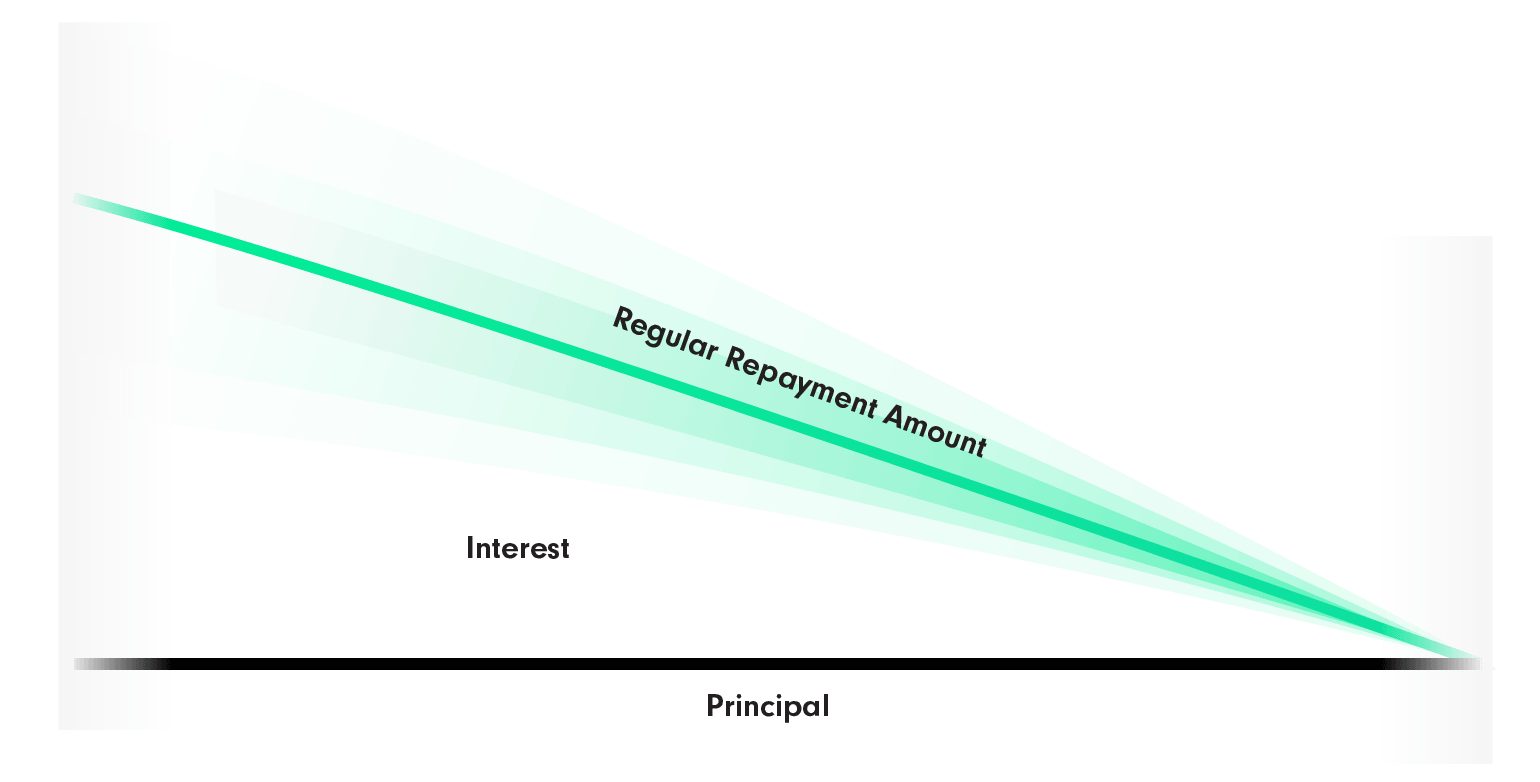

There can be other drawbacks too – for example your lender may require you to revalue every property in your portfolio (at great expense) every time you wish to sell one. And as your dependence on your lender grows they may decide to restrict the types of loan or rates available to you (only offering you principal and interest repayment terms, for example, rather than a potentially tax-efficient interest-only loan).

Refinancing your entire portfolio may enable you to get more favourable terms and conditions. Alternatively, you might be able to restructure your borrowings by taking out separate loans, with different banks on each property.

Since changing the structure of your loans could have a major impact on your tax position and long-term financial security, it’s very important that you review your investment strategy and any decision to refinance with your financial advisor.

How do I go about refinancing my property?

The process for refinancing is much like taking out your first mortgage:

- Shop around for the right lender and product

- Gather your supporting documents

- Apply, in person, online or through a mortgage broker

- Prove you meet the lenders’ eligibility criteria

- Prove the value of your property (you may need a new registered valuation)

- Sign your new mortgage agreement and pay all the costs involved

Once you’ve signed the deal, your new lender will probably take care of all the process and paperwork for you, including closing your accounts with your previous bank.